CoW Protocol Thesis

Executive Summary

CoW Protocol, a critical infrastructure provider for open finance, is re-evaluating their fee structures, business models, and tokenomics with the goal of earning a larger share of the market and increasing revenues. These changes could result in significant growth of revenue as the protocol continues to gain more of the market share across their two products: CoW Swap and MEV Blocker.

Kerve Capital believes these shifts may, over time, push CoW Protocol to achieve over $80M in annual revenue, resulting in a $1.2B market capitalization outcome. Deeper insights on the protocol, expected shifts, and market conditions are discussed below.

CoW protocol specializes in allowing blockchain users to find the best price available while preventing harmful MEV. MEV or “maximal extractable value” is a method used by bad actors to exploit your transactions at your expense.

CoW Protocol launched in February 2021, and is a spin off from Gnosis DAO. CoW Protocol currently has two products:

CoW Swap

MEV Blocker

CoW Swap is a fully permission-less decentralized exchange (DEX) aggregator on which anyone can trade any tokens and build integrations. Its core innovations are batch auctions promoting fair uniform clearing prices and trading protection from different sorts of MEV such as front/back running or sandwich attacks.

MEV Blocker is a free Remote Procedure Call (RPC) endpoint that protects users against harmful MEV. It prevents your transactions from unfavorable rates, saving you money in the process.

Both Cow Protocol products could benefit significantly from continued growth of the decentralized financial (DeFi) industry which we’re expecting to grow at a 82.5% CAGR over the coming years.

CoW Swap currently has a market share of just 14% of DEX aggregators but has been growing at a rate of 70% over the prior year. Meanwhile, 1inch, the largest DEX aggregator in the space has seen its market share decline from about 68% to 53%.

MEV Blocker, which launched in May 2023, is already doing 72% more volume than incumbent Flashbots. MEV Blocker has had astonishing growth with 450k unique users as of today and recent integrations into Rabby, Uniswap, and Brave wallets, with more on the way.

In the summer of 2023, the team at CoW Protocol realized that they must prioritize buoying their token price and have recently launched a plan to fix their tokenomics and launch their revenue model.

Reduce emissions over 40% by ceasing reimbursements of solvers’ gas costs in the form of COW tokens. The team has now proposed that solvers instead collect a “network fee” directly to cover their costs and eliminate the COW token reimbursement.

CoW Protocol team announced plans to test fee models.

CoW Protocol will start with a model that takes 50% from positive quote deviations. Over the past 12 months, this take rate from positive quote deviations would have brought in over $3.2M.

MEV Blocker will likely adopt a model that takes 10% from the validator fees. Over the past 12 months, a 10% take rate from validator earnings would have earned $5.2M.

CoW Protocol could conservatively be doing $8.4M in annual revenue upon turning on the fee switch across both products today.

Once CoW Protocol becomes self-sustainable, there should be an introduction of value accrual mechanisms to the COW token. These options could include staking for additional trading discounts, fee mechanisms to buy back and burn COW, or staking COW for revenue sharing.

Complexity reduction efforts are ongoing with subsequent roadmap items planned for Q1 2024.

Plans to be more decentralized as well as outsourcing more components to solvers.

Expand cross-chain to Binance Smart Chain, Polygon, other Ethereum L2s, and more chains in 2024.

Cross-chain price discovery is planned wherein users can submit an intent on one chain and solvers will look for the best possible price across multiple chains.

Expand into other token types (like ERC-721 and ERC-1155) during a CoW Swap v2 launch planned for 2024.

Technology Overview

CoW protocol uses an intent-based model. Unlike most DEX products, users on CoW Protocol do not execute their trades themselves. Instead of creating an Ethereum transaction for swapping token A for B (which costs gas, may fail, etc.) they sign an intent to trade the two tokens at a specified limit price.

This intent is then handed off to third parties - the so-called solvers - who compete for the user's order flow by trying to give them the best possible price. The solver that offers the best execution price is granted the right to settle the user's order. The actual settlement transaction is then created and signed by the solver.

Solvers are able to move tokens on behalf of the user (using the ERC20 approvals the user granted to the settlement contract) because the contract verifies the signature of the user's intent. Solvers then execute the transaction according to the limit price and quantity specified by the user.

Any time you make a transaction that carries value, you are at risk of being subject to MEV. Searchers can “frontrun” a transaction by submitting the exact same transaction before you and keep the profits for themselves. After getting frontrun, you can also get “backrun”, which is where the searcher cleans up any price slippage your trade caused, again keeping the profits for themselves. Both a frontrun and a backrun together are known as a “sandwich attack” — the worst type of MEV.

MEV gives you a worse price for your transactions and can result in losses of hundreds or even thousands of dollars. MEV Blocker is an easy solution - an RPC endpoint that protects all types of transactions from MEV.

CoW Protocol works by collecting trades over a period of time into a batch. This batch is then given to an external network of “solvers” who compete to provide the best clearing price for all tokens involved. Trades can be settled with on-chain exchanges directly or with DEX aggregators, depending on which path offers the best price.

We believe that intent-based architecture is going to continue to win out over traditional structures and that we’ll see many more protocols adopt this innovative structure because it ensures better execution and prevents the loss of money.

CoW Swap

CoW Swap is a fully permissionless Meta DEX Aggregator on which anyone can trade any tokens and build integrations. To date, the product has done over $30B in volumes, over 385K trades and over $82M surplus saved for users. Its core innovations are batch auctions promoting fair uniform clearing prices and trading protection from different sorts of MEV, such as front/back running or sandwich attacks.

Product Features:

No fees for failed transactions

MEV protection

Limit and TWAP orders

Programmatic Orderbook Framework

Allows users to deploy conditional trade intents en masse with just a single signature. Users only have to code the order logic.

Trade surplus is given to trader (vs keeping as profit like 1inch does)

Payment abstraction, i.e. users pay fee in sell token vs gas

Hooks

Allow users to set actions before and after a swap, e.g. staking/unstaking, claiming airdrop, bridging

Widgets

Allows CoW Swap to be easily integrated anywhere

MEV Blocker

MEV Blocker is a free RPC (built in collaboration with Beaverbuild and Agnostic Relay) that protects users against MEV.

Launched in May 2023, MEV Blocker facilitates order flow auctions at the builder level wherein searchers bid to backrun transactions coming from MEV Blocker. MEV Blocker allows searchers to “bid” in an auction to win the right to backrun your trade. When this happens, users of MEV Blocker receive 90% of the profit their backrunning opportunity creates (compared with 0% when not using MEV Blocker). In return for benefitting from backrunning your trade, these searchers are not allowed to frontrun or sandwich you — thus protecting you from the worst types of MEV.

MEV Blocker currently sends 90% of the profits to users, with 10% going to validators.

Mechanics of MEV Blocker are such that end users only get 90% of bid from the winning searcher. So if a trade creates a $20k backrunning opportunity, and a searcher wins with a 50% bid, they would pocket $10k, the user would get $9k, and the validator would get $1k.

Market Overview

CoW Protocol should benefit significantly from continued growth of the decentralized financial (DeFi) industry. Currently the DeFi market is about $30B vs. traditional finance which is $3T, just ~1% of the overall market. DEX aggregators connect to many trading venues and offer users best prices. In addition to general growth of the DeFi space, there are three major tailwinds working in CoW Protocol’s favor:

Digital asset trading volume will continue to grow at a ~20% CAGR.

We feel this is a very conservative assumption as major crypto assets like BTC and ETH have become institutionally adopted and prior trading volumes on major centralized exchanges have been growing at a CAGR of 400% over the prior 5 years (2017-2022).

In addition, spot DEX volumes topped out at about $210B a month in 2021, i.e. $2.5T in volume annualized.

Onchain exchanges will continue to gain market share over their offchain counterparts, growing at ~58% CAGR.

We believe that over the next 5 years, at least 20% of all digital asset trading volume will be handled by onchain exchanges. This would correlate to a ~10x growth in market share (or 58% CAGR) over their offchain counterparts over this 5 year period. This tailwind is due various benefits of being onchain like composability and transparency. We feel that this is a conservative assumption as onchain exchanges have been chipping away at offchain over the past year at a rate of ~70%.

3. Crosschain expansion will increase TAM by ~12% CAGR.

CoW Protocol is currently only on Ethereum but is set to expand crosschain in 2024. We expect this expansion starting in 2024, to increase the TAM by a 12% CAGR.

When we combine the thesis for the share growth of onchain exchanges with the assumption for the overall market growth, along with increasing usage of DEX aggregators and crosschain expansion, the result is a ~25x expansion for onchain exchanges in 5 years (or ~90% CAGR).

Note about DEX Aggregators:

As it relates to CoW Swap, DEX aggregators gaining significantly more usage at ~15% CAGR. DEX Aggregators connect to many trading venues and offer users best prices. We see DEX aggregators usage continuing to grow at the historical precedent over time driven primarily through wallet and DEX abstraction.

Market Share and Traction

CoW Swap Market Share and Traction

CoW Swap is a DEX aggregator that is continuing to gain market share because it has the best trade execution per quoted fees on meta aggregators like LLamaSwap. Their top competitor is 1inch.

CoW Swap has been gaining market share at a rate of 70% annualized, from about ~8% market share to ~14% market share across a selection of the leading protocols. Meanwhile, 1inch, the #1 competitor, has lost 20% market share over the past year, from about 67.6% to 53.3%.

Market share comparison Chart from Dune query

CoW Swap has significantly better retention than its competitors with a greater than 30% retention rate.

Competitors tend to have a 20-25% retention rate at best. This is one of the factors leading to CoW Swap’s continued market share growth.

We expect CoW Swap to continue to gain market share over 1inch and other competitors. Our base case assumption is that CoW Swap will continue to gain market share at a CAGR of 50%.

MEV Blocker Market Share and Traction

MEV Blocker’s biggest competition is Flashbots Protect RPC MEV-Share, which launched in October 2021. Despite launching in just May 2023 (seven months ago) MEV Blocker is already doing 72% more volume. MEV Blocker currently has about 450k unique users, doing an average of 229k transactions a month. MEV Blocker has added over 64k users a month and transaction volume has been growing at over 99% YoY. The product has now integrated with Uniswap wallet as of October 2023, Brave and Rabby wallets in November 2023 with more on the way. Kerve Capital believes MEV Blocker will continue to maintain market dominance and grow market share upwards of 90%.

MEV Blocker Transaction Volumes Chart from Dune query

Revenue Model

CoW Protocol’s revenue models have not yet been solidified, but work is being done to determine the best models. CoW Protocol’s revenue models can be incredibly sustainable, setting them up for a profitable future. Revenues will be taken from surplus profits that are today given back to users. Essentially these are monies that users are not expecting to get back, therefore we expect CoW Protocol will be able to be aggressive on the take rate.

CoW Swap Revenue Model

Users pay an estimated gas fee when they sign an “intent”. Solvers then go out and find the cheapest prices, and bundle transactions to execute the order as efficiently as possible.

However, there is frequently a positive quote deviation between the price quoted to the user and the actual execution, which results in a surplus profit that has been going back to users. This positive quote deviation between the estimated transaction fee (paid by users) and the actual transaction fee (paid by solvers) is potential profit as protocol fees. As of today, positive quote deviation is given back to the users, but upon the potential changes, a portion of this will accrue to the DAO as revenue. The most likely mechanism is for solvers to collect the protocol fee which would then be converted to COW tokens either by the solvers directly or by CoW Protocol after receiving the fee.

Although the team is exploring many different business models, the most likely business model is to take 50% from positive quote deviation. This is a very conservative take rate as users who are quoted a price are not expecting to get a trade execution better than the quote price.

Over the past 12 months, a 50% take rate from positive quote deviation would have brought in over $3.2M. Based on this revenue model, as of November 2023, the protocol is currently doing a $4M run rate, i.e. $335k monthly.

Potential revenue from a 50% take rate. Chart from Dune query

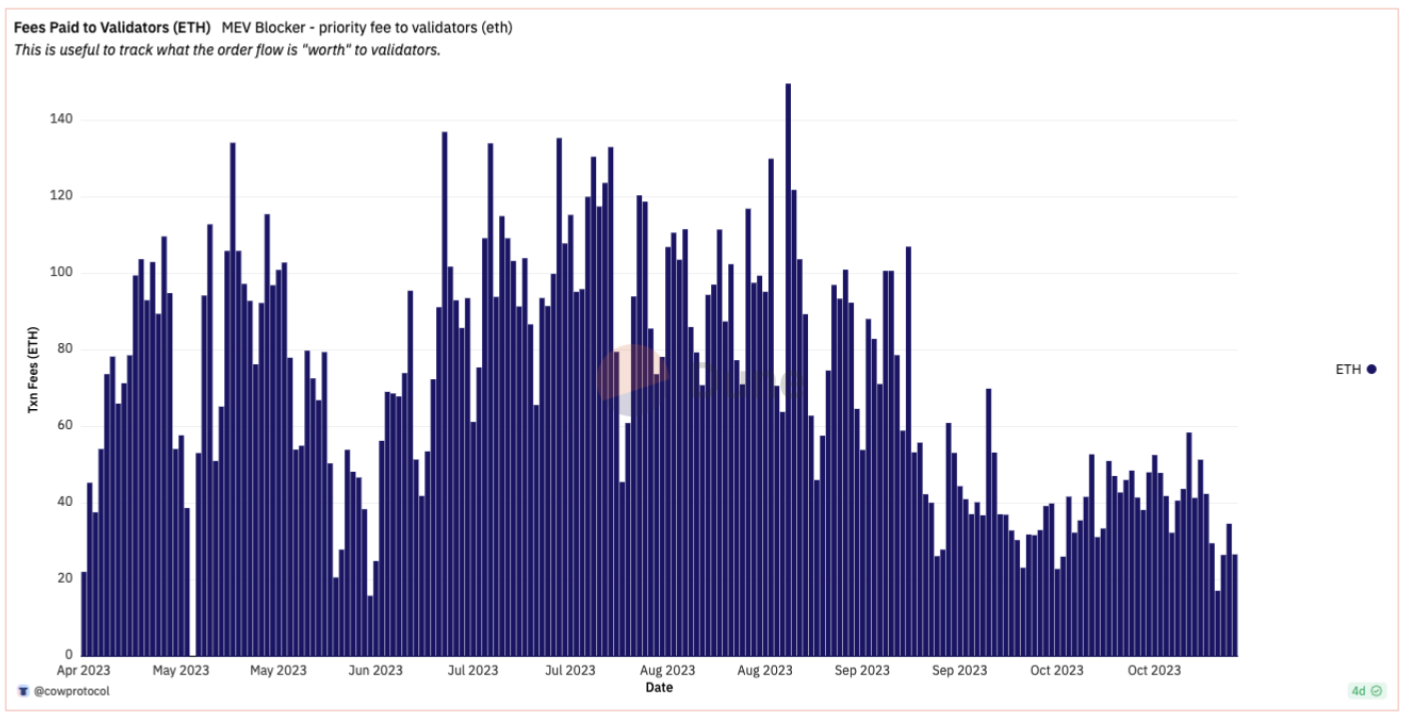

MEV Blocker Revenue Model

There are a number of viable revenue models for MEV Blocker. One of the ways of doing this is to take a cut of the backrunning profits. However, the team’s goal is to reduce MEV extraction from users, so the first path forward is to take a cut from earnings validators are making.

Validators are currently earning on average ~74 ETH per day (as of November 2023) and the team’s most likely starting point for take rate is 10%. We believe this 10% take rate number is overly conservative, but it remains a good base case to ensure consistent user adoption and superiority over competitive products.

Potential revenue from a 10% take rate from validator earnings. Chart from Dune query

A 10% take rate from validator earnings would earn $5.2M annualized based on prior 12 month volumes. However, we expect not only volumes to significantly increase, but also continued adoption of the product through wallet integrations and other partnerships.

Tokenomics

General token information

The COW token will entitle its holders with voting rights in CoWDAO. The main purpose of CoWDAO is to govern and curate essential infrastructure components of the CoW Protocol ecosystem, including:

System Parameters - CoWDAO will be in charge of all system parameters such as the objective function for solution scoring and solver slashing conditions.

Treasury holdings and Protocol revenue - Allocation of treasury holdings, distribution of Protocol revenue and investing into ecosystem projects.

Staking - CoW Protocol solvers will be incentivized to compete for providing best solutions by capturing value for participation. This could come in the form of trading fees, solution token rewards or both. Solvers could be required to stake COW in order to participate in solution submission. CoW Protocol users will be able to lock COW tokens for various benefits like fee discounts on trades or revenue sharing.

Fees and Rewards - Traders, solvers, frontends, developers and other ecosystem participants should always remain sufficiently incentivized to continue contributing and maintaining a robust ecosystem. Incentives could come in the form of batch solution rewards, trader incentives, ecosystem grants and more.

Investor Inflation

Investors have purchased COW tokes at $0.15. These investors are unlocking at a rate of 82.8k tokens per day. This is a current inflation rate of 18% per annum.

Other Inflation

Solvers are run by CoW Protocol as well as 3rd parties to process transactions and get paid with COW tokens for the work. Currently, CoW Protocol collects fees from users and then reimburses solvers’ costs with the COW token. The team has now proposed to replace CoW Protocol's current fees with a “network fee” and a “protocol fee” and ask solvers to collect both. Solvers would (calculate and) keep “network fees” to reimburse their gas costs and pay “protocol fees” to CoW Protocol (once a week in COW tokens). This would remove the COW token reimbursement which has been one of the drivers of token inflation. The token inflation paid to solvers has been about 20.38M COW tokens per year. Eliminating token inflation paid to solvers would result in a ~18% decrease to the overall token inflation (per prior 12 month inflation numbers).

As part of this proposal, the CoW Protocol has also announced plans to use protocol fees to buy back the COW token. This buyback would occur once a week through solvers converting tokens to COW in order to pay the “protocol fee”. Per the aforementioned most likely business model for CoW Swap, this buyback could be substantial and thus further reduce COW emissions by another 24% (assuming prior 12 month revenue numbers).

In aggregate, the team’s proposal would reduce token inflation by ~42%.

Fundraising and Runway

CoW Protocol has raised $15M from private investors and $8M from their community at a token price of $0.15.

The DAO Treasury has over $6M in ETH and stable coins, 480M COW tokens, and 14.5K in GNO tokens.

Team has runway through end-2025

Monthly burn is ~$300k

Upon launch of the base case revenue models, the protocol should be easily self-sustainable based on an annual burn number of $3.6M.

Valuation

Given the CoW Protocol business models are not yet turned on and mature, it’s difficult to predict what the future state of CoW Protocol will look like. We have attempted to contextualize what various scenarios could look like.

Please note that CoW Protocol has zero revenue today, and that today’s revenue is purely theoretical, based on assumptions the DAO has yet to formalize.

Base Case

CoW Swap TAM

Spot DEX volumes topped out at about $210B a month in 2021, i.e. $2.5T in volume annualized and have now hit $700B this year. With the aforementioned tailwinds of movements of volumes away from centralized exchanges to DEXs and continued growth of digital asset trading, we conservatively expect DEX Aggregator volumes at $500B per annum.

MEV Blocker TAM

MEV Blocker volume increases have significantly more potential due to how new the product is and how quickly it’s taken off as a simply better RPC that saves the average user thousands of dollars per year. We’re expecting an ~8x increase in volumes driven by new wallet integrations and wallet RPC abstraction driving more usage.

Market Share

CoW Swap’s market share is about 15% and growing at a 70% annualized rate. However, we’re conservatively expecting a 50% growth in market share moving forward.

Due to default installations in the most popular wallet providers, we expect MEV Blocker to continue to dominate the market at ~70% market share.

Take Rate

We believe CoW Protocol has upside on the take rate, but agree with the team’s analysis that it’s important to be conservative and test business model changes so as to not lose users with worse pricing and execution. The team has therefore landed on the most likely take rate to start as 50% for CoW Swap and 10% for MEV Blocker.

Upside Case

CoW Swap TAM

Our upside case uses the same framework as our base case. The upside case expects continued growth of DEX aggregators and $750B in annual DEX aggregator volumes.

MEV Blocker TAM

Our upside case assumes ~30x increase in volumes, driven by increased growth in the space and full product penetration as the default RPC.

Market Share

We assume CoW Swap will continue to chip away at 1inch and others, gaining 50% market share driven by significantly better performance and playing out continued growth rates we’re already seeing. Conservatively, we’re not expecting growth rates in this scenario to increase, but rather stay constant.

MEV Blocker will continue to expand its TAM and become CoW Protocol's stickiest product and highest revenue generator.

Take Rate

We assume the team is able to be more aggressive with the take rate after thorough testing, resulting in no uninstallations or drop in users. We assume users are not expecting to get better pricing than quoted or receive surplus savings.

Downside Case

Given crypto is so convex in its returns, the focus is usually on the upside. However, we do think it makes sense to show that CoW Protocol has limited downside. CoW Protocol has just $3.6M in expenses, which can be easily covered through a highly conservative take rate on surplus profits that were previously just given back to users as a bonus. Even if CoW Protocol saw zero growth after turning on the fee switch, they would have ample revenue to cover their costs. Other downside scenarios focus on the digital asset industry not growing or even shrinking. We believe these scenarios would lead to about only 25% downside from here.

Risks & Mitigants

Vesting and Sell Pressure

The COW token is widely distributed with a significant supply locked up with CoW DAO and GnosisDAO. CoW DAO and GnosisDAO hold 44.4% and 10% respectively, 54.4% of the total supply. Although investors are continuing to vest through 2025, they’re currently underwater on their investments. History shows that investors are reluctant to sell market sector leaders.

The majority of COW sell pressure over the prior year has come mainly from solver rewards paid out in COW. As mentioned, this solver reward sell pressure will go to zero, thus reducing COW emissions by over 40%.

Recession Risk

A major recession would obviously hurt CoW Protocol’s business and fundamentals just like many other companies. However, given that the crypto / blockchain sector has already been in a recession over the last 1-2 years, we remain agnostic to further pain in the broader economy.

Competition

Crypto markets are competitive, and there are other products. 1inch has done a very good job establishing itself as the market leader with quality marketing and business development. Flashbots has good brand recognition and a first mover advantage. However CoW Protocol has significant technological advantages, which are seen in its speed of adoption, market share growth, quality and retention rates. We are spending time closely monitoring both existing and new competitors in the space. We believe intent-based architecture design and MEV protection remain defensible moats.

Special thanks to the CoW Protocol team including Anna George and Alex Marsh who answered many questions. Data driven from Token Terminal and Artemis.

General Disclaimer

The information in this article was prepared by Kerve Capital IM LP (“Kerve Capital” or “we”) and is believed by Kerve Capital to be reliable and has been obtained from public sources believed to be reliable. All of the information contained herein is based on Kerve Capital’s independent research and analysis and publicly available information. Kerve Capital makes no representation as to the accuracy or completeness of such information. Opinions, estimates and projections in this article constitute the current judgment of Kerve Capital and are subject to change without notice. Any projections, forecasts and estimates contained in this article are necessarily speculative in nature and are based upon certain assumptions. It can be expected that some or all of such assumptions will not materialize or will vary significantly from actual results. Accordingly, any projections are only estimates and actual results will differ and may vary substantially from the projections or estimates shown. This article is not intended as a recommendation to purchase or invest in the CoW Protocol or its affiliates, or in Kerve Capital or any of its affiliates. Kerve Capital has no obligation to update, modify or amend this article or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, project on, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. There is no guarantee that the predictions or outcomes discussed herein will be achieved.

Kerve Capital, or its affiliates, acting as the investment manager of a pooled investment vehicle, has made certain investments in the CoW Protocol and therefore has a financial interest in the ultimate success of the CoW Protocol. While Kerve Capital believes that it has presented the information contained herein in an objective manner, its financial interest could lead to a conflict of interest or bias towards its belief in the success of CoW Protocol. Nothing in this article should be taken as an indication of any current or future trading or voting intentions, which may change at any time and from time to time, and which are reviewed on a continuing basis by Kerve Capital and determined based on various factors Kerve Capital considers relevant. Kerve Capital expressly disclaims any obligation to notify or update any person of any changes to such trading or voting intentions.

Certain statements contained in this article are forward-looking statements including, but not limited to, statements that are predictions of or indicate future events, trends, plans or objectives. Undue reliance should not be placed on such statements because, by their nature, they are subject to known and unknown risks, assumptions, and uncertainties. Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts and include, without limitation, words such as "may," "will," "expects," "believes," "anticipates," "plans," "estimates," "projects," "targets," "forecasts," "seeks," "could," "should" or the negative of such terms or comparable terminology. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Kerve Capital’s underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Kerve Capital that the future plans, estimates or expectations contemplated will ever be achieved.

Endnote #1.

The graphs, charts and other visual aids are provided for informational purposes only. Kerve Capital did not prepare nor does it make any representation as to the accuracy of such charts or graphs.